What is Payroll?

Payroll is a list of employees who get paid by the company. Payroll also refers to the total amount of money employer pays to the employees.

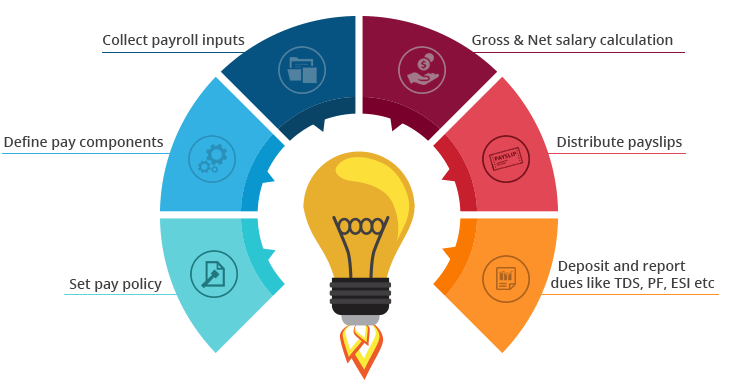

In short, we can say that payroll process involves arriving at what is due to the employees also called as ‘net pay’ after adjusting necessary taxes and other deductions.

The equation for calculating the net pay

Net pay = Gross income- gross deduction

Where,

Gross income or salary = All types of regular income + allowances + any one-time payment or benefit

Gross deduction = All types of regular deductions + statutory deductions + any one-time deductions

- 1.Accurate calculations

Automation helps ensure that wage calculations, payroll deductions and tax payments are correct. - 2.Compliance assistance

Some providers of payroll software notify employers about changes in employment or tax regulations that might affect their business. - 3.Access to tax forms

Employers may have easy access to important tax documents – Form W-4, Form W-2, Form 1099, Form I-9 and others – through their payroll software. - 4.Flexible payments

In addition to traditional paychecks, payroll software can usually accommodate direct deposit and alternative payment methods, like pay cards. - 5.Detailed recordkeeping

Many digital payroll systems create employee profiles with various payroll records that can be aggregated and downloaded to meet regulatory requirements. - 6.Employee self-service

Through a mobile app or computer, employees may be able to edit their personal information, change deductions, submit tax withholding information, view pay statements and more. - 7.Reduced payroll errors

Payroll software that can integrate with time tracking and HR programs cuts back on repetitive data entry, thereby helping prevent errors. - 8.Automatic alerts

Many payroll systems offer workflow notification. When the software detects a data entry error, if configured, it can send an alert to users so they can correct it before payroll is processed.

Hold on tight! Marg Payroll Software has some captivating features which you might not care for, but are a must-have for your business!

Employee Documents Get rid of carrying hard copies of employees’ documents all the time. Save a scanned copy of all the documents like voter id, Address proof etc. with you. | Automatic law updates We update our solution as per the amendments made by the govt. while you relax on a coffee table with fellows. | Easy to Use An intuitive and employee friendly interface. All menus are placed rightly and reports that are easy to understand. |

Biometric IntegrationHrXpert can be integrated to any biometric system. Ex - eSSL, Real-time, and can be integrated to Biometric software via SQL, MS Access, Text or Excel | Excel Import Attendance data can be imported via Excel in defined formats | Manual Attendance Attendance details can be managed manually via Mis punch, Leave & Late coming validation. |

Overtime & Shift managementMultiple shift/Roster and Overtime management is simple and more effective in HrXpert Payroll Software | Multiple Leave policy managementMultiple types of leave could be maintained as per company policies, like EL, CL, PL, SL in HrXpert Payroll Software. This will also help you to define the allotment, carry-forward, Lapse etc. automated or manual. Also, we can define maximum leaves in an employees’ account. | Multiple Salary Structure ManagementManage various types of salary structure as per company policies, like fixed salary structure, formula driven salary, component wise provision of salary bifurcation, fixed + variable salary option, daily wages salary provision etc. |

Bifurcation of employeesBranch, Division, Department, Grade, Designation, Category, Grade creation as per company structure | Reporting to creationProvision to create reporting heads and reporting executives for defining the hierarchy tree in an organization. |

Arrears and increment payment |

Bonus paymentBonus payment options as per govt. rule and company policies and concern reports generation required for statutory compliance. | Birthday, Anniversary managementProvision to track and notify the employees birthday, anniversary etc. and help HR department for sending the greetings for same immediately via HrXpert Payroll Software. | CTC managementProvision for maintaining Cost To Company is much impressive in HrXpert Payroll Software. This helps organizations to maintain the costing of each employees at a single place. Concern MIS reports generation is effective & easy. |

Pay-slip, email PayslipEmailing option for generated payslips. Selection can be done for personal or Professional mails. Various types of formats are given to generate in Quick, PDF or Excel format from HrXpert Payroll Software. | Salary sheet and other salary reportsHrXpert Payroll Software help you to generate monthly as well as yearly salary reports in a number of formats in Quick view, Excel etc. | Monthly and yearly salary MIS reportsHrXpert Payroll Software provides multiple types of reports based on salary, reimbursement, advance, bonus, incentive etc., in quick excel format. |

Monthly and yearly salary MIS reportsHrXpert Payroll Software provides multiple types of reports based on salary, reimbursement, advance, bonus, incentive etc., in quick excel format. | Full & Final settlementAfter putting the Date of Leaving, you can process for full & final settlement in HrXpert Payroll Software. It also help you to adjust loan/Advance, Incentive, Asset or any other payment/deduction. The format gives brief details of employee details and salary. | User wise credentialsHrXpert Payroll Software maintains the user wise log report. This will help you in getting details of edits and modifications made by the other user in the software with date and time. |

Loan & AdvanceWith this feature, employees can request for loans or advance salary from the portal only. Whereas, Hr department can manage all other details at one lace like load requested by the employee, loan approved by the company, EMI, loan repayment tenure etc. bringing transparency to the system. | Payroll ComplianceProvident fund management (PF), with monthly returns as per govt standards. Online return ECR can be generated directly from HrXpert Payroll Software. Generate and Upload on PF site. It’s that simple. | Asset ManagementHr department can manage the assets given to a particular employee in the company along with the configurations and quantity all at one place . So, that whenever the employee leaves the company, it becomes much easier to get all the assets back in the condition it was given. |